Chapter 5: Make Business Taxes More Competitive

A page within Menard Family Initiative

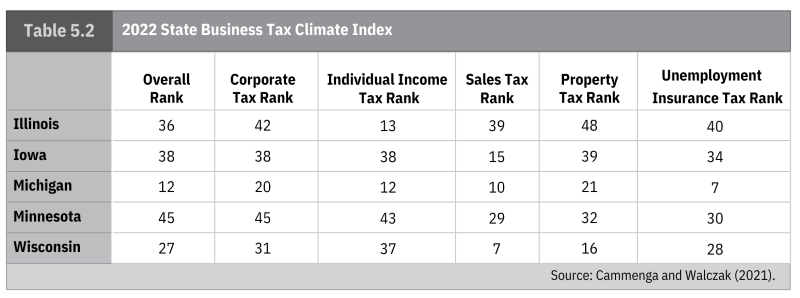

In Chapter 5, Claudia Williamson Kramer dives deeper into taxes and discusses how – at the state and local level – they significantly impact business activity. Table 5.2 displays how Wisconsin and its neighboring states compare according to the Tax Foundation’s 2022 State Business Tax Climate Index.

Table 5.2

Table 5.2

With an overall rank of 27, Wisconsin performs worse than most states, but better than Illinois, Iowa, and Minnesota.

Kramer also explores how Wisconsin compares to its neighbors and the national average on the various types of business taxes. Wisconsin's business tax revenue mainly comes from property taxes, sales taxes, and corporate income taxes. As Kramer shows, “Wisconsin collects 39 percent of its business tax revenue from taxing property, making property taxes the category with the largest share of Wisconsin’s business tax burden.” Further, “Wisconsin’s corporate income, unemployment insurance, and license tax burdens are higher than the national average, but its sales, excise, and passthrough income tax burdens are slightly lower than the national average.”

Kramer then discusses a report which divides business property taxes into three categories: commercial property, industrial property, and apartment buildings. As she shows, “Wisconsin taxes all three categories of business property at higher rates than the national average.” In fact, the state ranks 40th and 44th on commercial property and apartment building taxes, respectively, implying that it has some of the highest tax rates on these types of property nationwide. Kramer cites a study finding that property taxes impose severe costs on businesses. Since such taxes are paid regardless of profits, “they have the strongest negative effect on the establishment of small businesses, since many new businesses are not profitable in their first few years.” Furthermore, the study finds that “a 10 percent cut in business property tax rates would increase business activity by 1 to 5 percent.”

Wisconsin's tax rates also vary greatly across industries and firm ages. New and mature capital-intensive manufacturing firms face lower taxes, while corporate headquarters and distribution warehouses face higher taxes. As Kramer argues, these variations in tax rates result from various tax incentives provided to specific industries and in particular circumstances, which shifts burdens to other industries, distorts economic incentives, and complicates the tax code. To address this issue and improve the state’s business environment, Kramer argues that Wisconsin should simplify its tax system by implementing broad-based, uniformly lower tax rates and eliminating business tax credits. The full chapter provides much greater detail on various tax rates in Wisconsin and its neighboring states.