Affording college

A page within It Make$ Cents!

Tuition and Housing Costs

START HERE!

Estimate your campus bill – Estimate your campus bill | UW-La Crosse (uwlax.edu)

Here are the tuition costs for the 2025-2026 school year:

WI Resident:$10,657 |

MN Resident:$11,187 |

Non-Resident:$20,575 |

Click Here to see Tuition Costs for Out of State and International:

Cost to attend – Cost to attend | UW-La Crosse (uwlax.edu)

ON CAMPUS? HERE ARE THE COSTS!

Cost for 2025-2026 Semester and Year:

Standard Double:per semester: $2,346.50year total: $4,693 |

Eagle Hall:per semester: $2,816year total: $5,632 |

Reuter:per semester: $3,586.50year total: $7,172 |

Standard Double Dorm Standard Double Dorm |

Eagle Hall Eagle Hall |

Reuter Hall Reuter Hall |

Get more info about Housing Costs here:

Rates & costs – Residence Life | UW-La Crosse (uwlax.edu)

ON CAMPUS MEAL PLAN BREAKDOWN:

There are many options on meal plans for students living on campus at UWL. The Stryker Classic plan is the most common plan for most students. Use this link to explore more about each meal plan offered at UWL:

Dining plans – University Centers | UW-La Crosse (uwlax.edu)

Meal Plan Costs (Fall 2025 Semester):

Stryker Classic:$1,596 |

Stryker Deluxe:$1,932 |

The Reuter Plan:$538 |

BREAKDOWN OF TUITION AND FEES:

Not many students know all the resources they have access to that are included in their tuition and student fees. Here is a breakdown:

Access to the Student Health Center

CAB Events

REC membership

Textbooks

Counseling Center

Canvas Fees

And So On!

Campus Cash vs Maroon Dollars

Campus Cash

Campus Cash  Maroon Dollars

Maroon Dollars

Campus Cash: Separate entity that is added via check/cash/student bill

Maroon Dollars: Included with meal plans (Stryker Classic, Stryker Deluxe, Reuter Plan)

UWL Sponsored Scholarships

Visit UWL's Scholarship Resource Center

HOW TO MAKE A BETTER SCHOLARSHIP ESSAY:

- Be Personal and Specific!

- Tell a story!

- Don’t just copy and paste an essay, tailor it to the scholarship

- Don’t change your image of yourself in the essay

- Make sure to read the directions

How Much Do I Need to Borrow?

college loans

college loans

What Loans are Available to College Students?

Federal Direct Student Loans

UW-La Crosse participates in the William D. Ford Federal Direct Loan Program; with Direct Lending, the lender is the U.S. Department of Education.

- All students who wish to borrow a Federal Direct Loan must complete a Free Application for Federal Student Aid (FAFSA).

- The Financial Aid Office will process the student's FAFSA and send an e-mail notification when the financial aid offer is ready to review and accept in the WINGS student center.

- All first-time Direct Loan borrowers need to complete the federally required Direct Loan Master Promissory Note (MPN)and Entrance Counseling before their loans will be disbursed.

- The federal government pays the interest on Federal Direct Subsidized Loans until the student falls below half-time enrollment and during the six-month grace period. The interest on Federal Direct Unsubsidized Loans begins accruing once the loan is disbursed. Both loans go into repayment six months after the student is no longer enrolled at least half-time.

Federal Direct Parent PLUS Loans

- The Federal Direct Parent PLUS Loan Program provides loans for parents of dependent students attending post-secondary schools.

- A Free Application for Federal Student Aid (FAFSA) must be completed in order to determine eligibility for Federal Direct Loans before a Parent PLUS Loan will be processed.

- The Direct Parent PLUS Loan is an education loan, with an interest rate of 8.94% for the 2025-26 academic year, that allows a parent to fund up to the entire cost of their student's education minus financial aid already awarded. This loan also has an origination fee of 4.228% which is deducted from the loan before it is distributed.

- Eligibility is based on credit worthiness of the parent. Parents and/or step-parents of dependent undergraduate students are eligible to borrow under the Federal Parent PLUS program.

- Parents must complete a Master Promissory Note (MPN) in order for this loan to disburse.

- Eligibility is based on credit worthiness of the parent. Parents and/or step-parents of dependent undergraduate students are eligible to apply for a Federal Parent PLUS Loan on behalf of the student.

- To apply, go to the Federal Direct Parent PLUS Loan page.

Private Student Loans

- Students who need additional funds for education, beyond what was awarded on their financial aid offer, might consider a private student loan.

- These loans are private student loans from a lender and are not guaranteed by the federal government.

- Approval of a private student loan is based on creditworthiness. Most students will require a co-signer.

- The student should file a Free Application for Federal Student Aid (FAFSA) to determine eligibility for federal and state aid before applying for a private student loan.

- To apply, go to our Private student loans page.

- For more information, go to UW Credit Union to see if a private loan is right for you.

For more info, visit https://www.uwlax.edu/finaid/info/types-of-aid/loans/

Subsidized vs Unsubsidized?

The federal government pays the interest on Federal Direct Subsidized Loans until the student falls below half-time enrollment and during the six-month grace period. The interest on Federal Direct Unsubsidized Loans begins accruing once the loan is disbursed. Both loans go into repayment six months after the student is no longer enrolled at least half-time.

Interest Rates

interest rates

interest rates

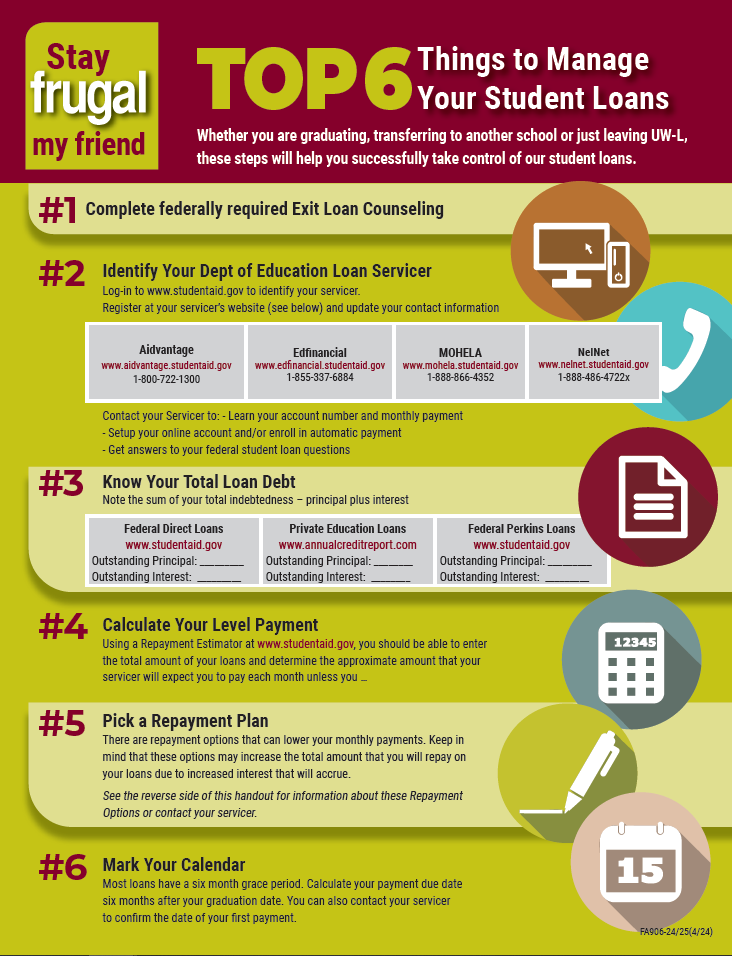

How Do I Manage My Loans?

- Student Loan Calculator

- Learn who your federal loan servicer is by going to https://studentaid.gov/manage-loans/repayment/servicers

Colored sign listing top 6 things to manage your student loans

Colored sign listing top 6 things to manage your student loans

FA906 24-25 Top 6 Things To Manage Your Student Loans.pdf

Student Loan Repayment Support

Can I Start Making Payments Early?

The Grace Period

For most federal student loan types, after you graduate, leave school, or drop below half-time enrollment, you have a six-month grace period before you must begin making payments. It is important to note that for most loans, interest accrues during the grace period. You may pay this interest that accrues during your grace period.

Loans and Grace Periods

- Direct Subsidized Loans and Direct Unsubsidized Loans have a six-month grace period before payments are due.

- Parent PLUS loans do not automatically have a grace period, but they can request one. If you received a PLUS loan as a graduate student, you’ll automatically get a six-month deferment after you graduate, leave school, or drop below half-time enrollment.

Factors That May Affect Your Grace Period

- Active duty military—If you are called to active military duty for more than 30 days before the end of your grace period, you will receive the full six-month grace period when you return from active duty.

- Returning to school before the end of your loan’s grace period—If you reenroll in school at least half-time before the end of your grace period, you will receive the full six-month grace period when you stop attending school or drop below half-time enrollment.

- Loan consolidation—If you consolidate your loans during your grace period, you give up the remainder of your grace period and begin repayment after your Direct Consolidation Loan is processed.

More articles about paying interest while in school:

- https://www.nerdwallet.com/article/loans/student-loans/student-loan-interest-capitalization

- https://www.moneygeek.com/financial-planning/paying-for-college/pay-down-student-loan-debt/

- Trailblazing companies that will help you pay off your student loans faster

Do I Qualify for Student Loan Forgiveness?

- You can read about student loan forgiveness here: https://studentaid.gov/manage-loans/forgiveness-cancellation

Food Insecurity

People who are food insecure are those who do not have access to enough or nutritionally adequate food. Here are some signs of food insecurity:

- Resort to emergency measures such as scavenging or stealing food to survive.

- Experiencing hunger as a result of running out of food.

- Eating a poor-quality diet as a result of limited food options.

- Having anxiety about getting more food.

Click here to learn more about Food Insecurity.

Resources

La Crosse Area Food & Nutrition Resources

Here is a brochure filled with a ton of different programs, emergency food resources, home delivered meals, and free community meals information.

Meal Plan

UWL offers many different dining plan options for students that live on-campus and off-campus. Consider purchasing a plan that fits your needs!

Food Pantry

UW-L offers an on-campus food pantry or all students. It is located in 2220 Student Union, inside the COVE.

For more information on other food pantries in the La Crosse area, click here.

The Kane Street Community Garden

Kane Street Garden operates from March thru October and is located in North La Crosse on the corner of Kane and St. Cloud Street. Please visit Kane Street Garden to see the hours of operation, when you can pick up free produce, and volunteer.

FindHelp.Org

Find food assistance, help paying bills, and other free or reduced cost programs, including new programs for the COVID-19 pandemic here.

Eagles Helping Eagles

The UWL Eagles Helping Eagles program, administered by the UWL Financial Aid Office, provides donated new/gently used household goods like pots, pans, crockpots and dishes.

Student Life

The UWL Student Life Office offers many different emergency resources for students. Visit them here: https://www.uwlax.edu/student-life/emergency-resources/

FoodShare

The Wisconsin FoodShare program is available to students that work at least 20 hours per week or participating in a work study program. Click here to apply. *Note: Students that live on-campus and have a meal plan that pays for more than half of their meals are not eligible for FoodShare.

- FoodShare Video: What is it and How Can I Apply?

- FoodShare Guide to Applying

- FoodShare Makes Wisconsin Healthier

- Work Rules for FoodShare Applicants

IMC Blog

Check out our blog for cheap food ideas and other information on being frugal with food!

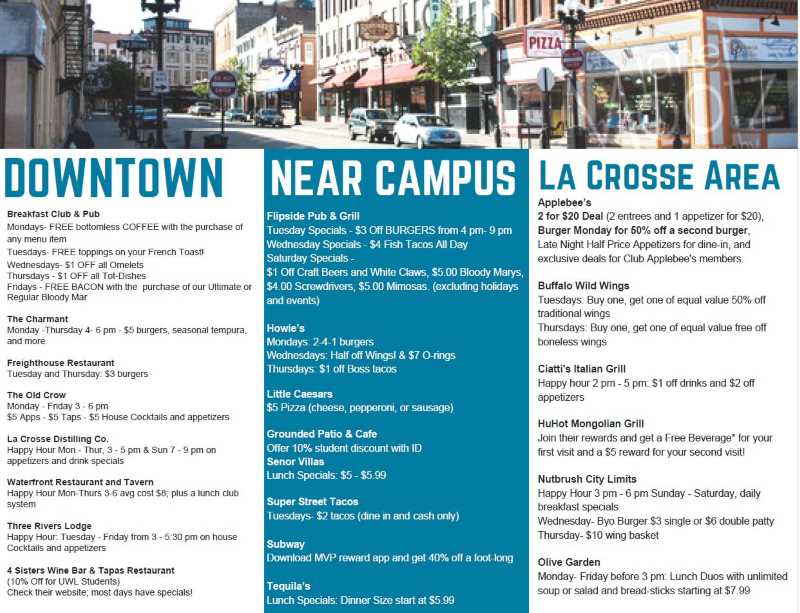

Cheap Eats in La Crosse

And more!

You can check out more food resources here!

Renting

Apartment For Rent Sign

Apartment For Rent Sign

Finding a place to live in a college town is difficult with the amount of turnover. Here are some great local sites to get your search started:

- UWL Off-Campus Housing Marketplace

- Rent College Pads

- Student Rentals La Crosse

- Coulee Region Apartment Connextion

- 7 Rivers Rentals

- Trulia (The map on this site also shows crimes and affordability of the areas of La Crosse)

- UW-La Crosse Off Campus Housing Facebook Page

- La Crosse Apartment Guide

- Findhelp.org

- Local Landlords

Finding an Apartment

The university does not own any apartments so all off-campus housing involves a rental agreement with a landlord. There are many apartments around the campus area, many within walking/biking distance from the campus. You can check some out on the UWL Off-Campus Housing Marketplace. If you are looking for an apartment a little farther away, as a student you have free access to the MTU city bus with your student ID.

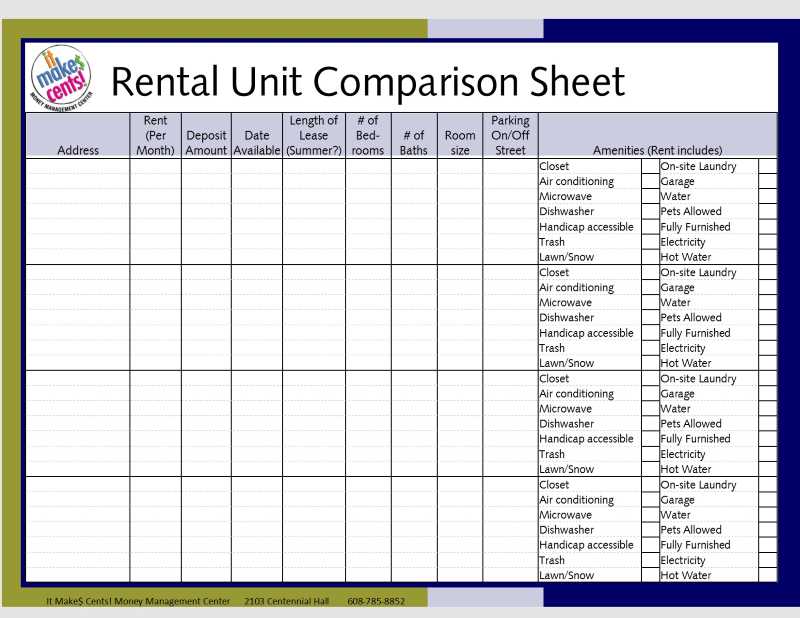

When looking at multiple apartments and trying to decide what best fits you and your budget, our rental comparison sheet can be a useful tool to keep information handy.

Scam Alert!

Scam Alert!

Avoiding Rental Scams can be difficult. Unfortunately, scammers are always looking for a quick way to get money and college students seem to be among their favorite targets. Follow the link for some quick tips about how to avoid being a target.

Renters Insurance

Renters Insurance

Renters Insurance is a great way to protect yourself, is relatively inexpensive, and is usually pretty cheap. UWL alum, Scott Bramwell, shares his story in Renters: Get insurance! and will explain why it is so important to have renters insurance.

5 Reasons to be Insured

#1 Renters Insurance Is Dirt Cheap

In most major metropolitan markets, renters insurance will cost you less than 50¢ per day. You heard it right – most quality insurance policies that will replace your possessions in case of damage or loss due to fire, storm, smoke damage, theft, or other covered circumstances. For an annual fee of $150, up to $30,000 in personal property will be covered and if you own more costly gadgets, you can get that covered for around $200 per year.

#2 Renters Insurance Also Covers Negligence

This may sound like no big deal, but suppose one of your friends is hanging out at your place, trips over your strand of fairy lights and takes a header into your coffee table. They need 60 stitches, have no insurance and decide to sue you for negligently stringing Christmas lights out of season (no matter how festive they are). That’s not what a true friend would do, but it happens. If you’ve got renters insurance, your insurer will deal with the suit and it won’t ruin your finances.

#3 Renters Insurance Will Help You Replace Your Stuff

You may think you don’t have a lot of assets, but imagine if a fire swept through your place and it was ALL gone – all of it! That’s no TV, laptop, tablet, clothing, cell phone, furniture, etc. Without renters insurance, you’d be out of luck. Be sure to opt for a policy that guarantees “replacement cost coverage,” otherwise the amount you get could be just the fair market value of your lost, stolen or destroyed items. And used stuff is worth surprisingly little.

#4 Renters Insurance Helps You out When Disaster Strikes

If a fire does hit your building and your apartment is fire or smoke damaged, you’ll have to move out while repairs are made. Where will you go? Where will you live while repairs are made? Renters insurance will cover the costs for you to stay in a hotel (if it’s short term) or a replacement rental (if it’s a longer term repair). Be sure to look for this rider in your policy to make sure you have this protection. Some policies will also cover storm and natural disaster – be sure to check.

#5 Renters Insurance Protects You from Theft

Not only does renters insurance reimburse you if your apartment or rental home is pilfered, but it also covers you if stuff is stolen out of your car. What’s more, if the thieves damage your property while carrying out the crime that will be covered as well. If your door is broken, your landlord should pay that expense (their insurance will cover it), but your stolen TV, laptop and other items should be filed on your renters insurance. Be sure to file a police report promptly.

Choose Your Roommates Wisely

Joey and Chandler - Roommates

Joey and Chandler - Roommates

Living with someone is not an easy task. Both you and your roomie(s) will need to make some agreements and set some boundaries BEFORE actually living together. It helps to outline expectations around: food, bills, space, money, parking, pets, guest...etc. Communication is key, but better to have these items outlined ahead of time so that you are in agreement on how life will run when living together. Check out our Roommate Agreement Form! We are hoping this will help y'all keep the peace.

Know Your Rights As a Tenant

These 10 items CANNOT be part of your renting agreement. If so, the lease is null and void.

Ten Deadly Sins of a Lease

Additional renting information, knowing your rights and filing complaints:

Before you movie in- make sure you to do an inspection check-in and write everything down as it is. It is also helpful to take pictures. It is important to make known any items that need to be fixed or serviced before you move in. Here is a sample Inspection Check-list for you and your landlord to use if they don't have one to provide you with.

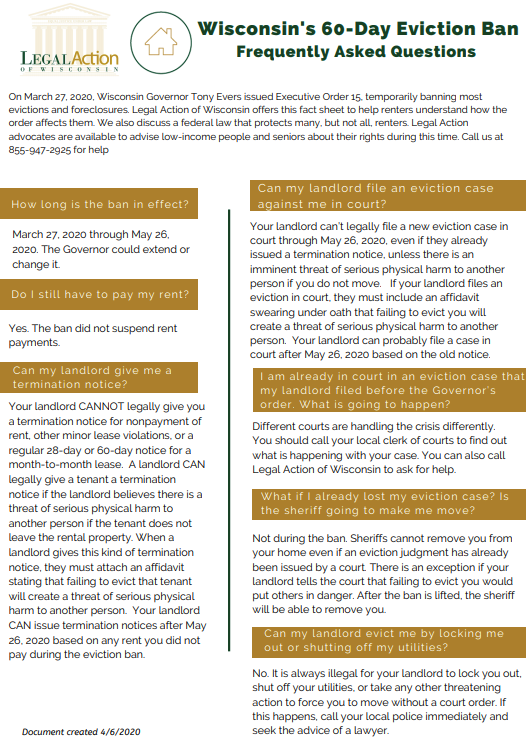

Legal Action of Wisconsin is non-profit law firm that's great for renters who need legal support but may have a tight budget.

60 Day Eviction Ban

60 Day Eviction Ban

Tenant Safety

La Crosse Fire Department Logo

La Crosse Fire Department Logo

Smoke alarms save lives! Read about the importance of installing and maintaining smoke detectors within your off campus home here.

Wisconsin Laws

Frequently Asked Questions

IT MAKE$ CENTS! OFF CAMPUS HOUSING FAQS

Note: This guide is meant to serve as a resource when moving off campus—it is not meant to serve as legally binding decrees. All issues beyond this guide should be addressed to an attorney or real estate agent. Also, be aware that many issues with landlords, leasing, property, etc. can be handled with solid communication prior to the issue becoming too large to control.

I am having problems with my roommates. What can I do?

Roommate conflicts are almost guaranteed to occur—no matter who you choose to live with. If your roommate signed the lease, there is not much you can do to have them evicted from the property. Also, if your name is on the lease, you are responsible for ensuring the landlord receives their full amount even if your roommates is unable to provide their portion. In order to prevent these types of issues from occurring, be very selective with your roommates. Live with people you trust and can count on. Don’t choose a roommate simply because they’re available and willing to move in together.Can a landlord put whatever they want in my lease?

The short answer to this question is no. The longer answer is a bit more complicated as certain clauses are allowed, while others (like a fee or rent increase for a noise complaint) are not legally allowed. The best thing you can do is to carefully review your lease and bring up any concerns to your landlord before signing. Once the lease it is signed, it is imperative to follow it. Lease provisions are mandatory, not suggestions.What kind of clauses should I look for?

Leases will contain lots of information. Everything from rent owed, security deposits, pet restrictions, and damages could be found in the lease. While it is impossible to list every nonstandard clause, here are some of the most common issues to look out for:Common Area Maintenance (CAMs)

CAM clauses refer to maintenance of common areas in and around the property. These clauses could include things such as lawn maintenance or snow removal. If you’re living in a property where there are multiple units (such as a duplex) it is important to understand who is responsible for managing these tasks, especially snow removal. Failure to maintain proper lawn care or snow removal could result in fines that are passed directly onto the tenants.Non-Standard Clauses

Most landlords are good, decent property owners and have their tenants’ best interests in mind. Sometimes, however, a landlord will try to sneak in clauses that are illegal and will often threaten tenants if these abnormal requests are not met. One of the most frequent requires that a tenant pay a fee or be subjected to a rent increase if a noise complaint or police response is required at the residence. This is a non-standard and, according to Wisconsin law, illegal clause. Be sure to keep an eye out for these clauses and discuss with a landlord prior to move inCarpet Shampooing!

Quite often a landlord will ask that tenants shampoo their carpet prior to moving out. While it is not illegal for a landlord to require that a tenant shampoo the carpet, they can only do so if there is damage beyond normal wear and tear. For example, if you have a dog and there are pet stains you could be liable to a carpet cleaning. Similarly, if you were to host a party and a friend were to stain the carpet you could be liable for carpet cleaning. You are not responsible for replacing or cleaning an aging carpet if your behavior was not abnormal or cause any stains.How do I get my security deposit back?

A security deposit is money collected by your landlord at the start of your lease to help offset any costs for possible damages to the property. Landlords will return any unused portion of your security deposit at the end of your lease. The best way to ensure your money is returned to you is to conduct a damage walk through prior to moving in. Be sure that your landlord is present during this walkthrough so you can document, photograph, and be aware of any existing damages or needed repairs. After the conclusion of your lease, complete an exit walkthrough with your landlord to compare the state of the property as you move out. Keep your copy of the original damage walkthrough handy so you can ensure that you are not charged for an issue that existed prior to your move in. Ask the landlord to also write you a check following the conclusion of the damage walk through upon move out.My landlord isn’t responding to my request to complete a repair. What should I do?!

If your landlord isn’t being diligent or responsive to your request for a repair, you need to examine the severity of the repair. If the repair is necessary to your safety (a hole in the ceiling during winter, doors/windows unable to lock) then call the La Crosse City inspector and they can provide assistance. Landlords must respond promptly if the repair has an impact on the safety of you in your home. If the repair does not impose an immediate threat to your safety (hole in wall, broken tile, etc.), then a landlord may move more slowly but they are still responsible for repairing the property. In this case, the best action to take is to keep in touch with your landlord and document all communication surrounding the issue. Use email for electronic record keeping, keep a phone call log with date/time/outcome, and send a certified letter if you must. If the landlord still refuses to move on the issue, you can begin to explore your legal options, but this should be done only as a last resort option and with proper documentation of previous contact attempts.Moving off campus is an exciting first step to your total independence and development as a young adult. You need to be aware of the unintended costs of moving into a off campus house (heating, internet, food, etc.). Additionally, you need to review the lease carefully and ensure that you are moving in with trustworthy roommates. The best advice is to be diligent, intentional, and thorough with this process. Taking extra time and effort could be the difference between saving you hundreds or thousands of dollars in the long run.

COVID-19 Resources

W.R.A.P - Wisconsin Rental Assistance Program

The Division of Energy, Housing, and Community Resources are partnering with the Wisconsin Community Action Program Association, a trusted community partner to provide direct assistance to residents of Wisconsin administering this funding. Check out their website or infographic for more information:

Internet Resources for Wisconsin Residents during Public Health Emergency

Calculator Image

Calculator Image

Everyone needs a calculator at some point in their life...Might not be the typical one on your desk either, but either way, it is best to know your numbers! Below are some financial calculators that will make managing your personal finances easier.

Cost to Attend UWL

While the overall costs of attending college vary with each student, there are certain costs which can be anticipated. Whether you're an undergraduate, graduate, or international student, use this calculator to figure out your cost to attend UWL. Cost to Attend

Cost of Living Calculators

Moving away from La Crosse? Use this Cost of Living calculator to compare living expenses in different cities. This will also show the difference in income to have the same amount left over after rent.

Are you planning on studying abroad? International travel is a rewarding experience. However, it is a good idea to budget living expenses and get familiar with prices abroad. Use this calculator to find the average cost of living and prices. Remember to consider exchange rates!

Are you planning on buying a house or a new car? Use this calculator to estimate your monthly payment!

Calculating Your Income

How much will you make in the field that you are going in? Get a glimpse at what the median salary is for the job you are looking at. Take a deeper look at your actual take home pay each month. Remember, gross and net pay is different!

Student Loan Calculators

When you graduate, you have a six-month grace-period before your required student loan payments start. Go to www.studentaid.gov and log in to find student loan amount and loan provider. Then, you can use this calculator to estimate your monthly student loan payment.

Debt can be an uncomfortable subject to talk about, and it easy to fall into the trap of “worrying about it later.” 80% of Americans have debt of some kind. While debt is a slippery slope that can lead to a financial crisis, it can also be a useful financial tool that opens up opportunities that would otherwise be unavailable. In this section we will do a brief survey of the different kinds of debt and sound financial practices. I have divided several types of debt into two categories: “Bad” Debt and “Better” Debt.

“Bad” Debt has little to no financial benefit, but it can be useful for emergency situations or acquiring products you want earlier. “Better” Debt, on the other hand, can be leveraged for a better financial return compared to the rate on your loan. Note that “Better” debt is still not “Good” debt because the only good debt is the debt you don’t take. All debt is a financial liability, so, if possible, it is best to pay for things in full.

Debt

Debt

"Bad" Debt

Credit Cards

Credit cards are an integral part of personal finance; they allow you to purchase goods without having the money to do so which is particularly useful for salaried employees on a monthly payment plan. However, this is a risky agreement for both the bank and credit card owner, thus it has one of the highest possible interest rates ranging from 15-30% APR. While credit cards are not evil (and quite useful if used correctly), if the revolving balance is not paid in full every month, that interest rate will be applied and added to your unpaid balance. If there is debt lingering on a credit card for multiple months, interest will be also be charged on the previous month’s interest i.e. compound interest. Credit card debt snowballs quickly and should be paid off as soon as possible.

Car Loans

Cars are an integral part of modern society which makes taking out a car loan seem like a practical expense. Cars provide convenience and luxury, but car loans can be devastating from a financial standpoint. Getting to work is a need, but getting to work in a new car is a want. I’m not saying buying a new car is a bad thing, but as with other wants, it should be a planned expense you save up for. Cars are depreciating assets, so they lose value proportional to their age and miles driven (which is particularly true within the first few years). Taking a loan out for a depreciating asset is a double loss. This is where used cars come into play. A nice used car fits its purpose without the substantial price of a new car. Given all this, it is still worth it for many people to buy a new car, but just keep in mind it comes at a cost.

Unexpected Debt

Life is risky. The unexpected is always lurking around the corner. Most of the time the unexpected is benign, but in extreme circumstances it will throw you into financial ruin if you are inadequately prepared. Examples of this would include car crashes, medical expenses, losing work, and lawsuits. Each of these are unlikely to happen on any given day, but chances are all of us will experience at least one of these situations in our lifetime, so it is worth it to be prepared. The two financial safety measures available are: 1.) An emergency fund and 2.) Insurance. An emergency fund is money put away in a savings account and only used in, you guessed it, emergencies. Insurance is the necessary evil in our life that chips away at our paycheck every month but protects us from unexpectedly falling into severe financial trouble. Taking these preventative measures is the only way to prepare for the potentially significant cost of unexpected debt.

"Better" Debt

Home Mortgages

Owning a home is something many strive to achieve some day. This would be an impractical goal for many if there weren’t house loans also known as a mortgage. Instead of saving for the hundreds of thousands of dollars needed to buy a home, the mortgage allows us to live in a house by saving only 20%-30% of the cost for a down payment. Furthermore, the interest rates on a home mortgage are some of the lowest rates relative to other types of debt, but that is not the only reason this is a better type of debt. Homes, unlike cars, will appreciate in value over time. Not all housing markets are created the same, so there is significant variation in the previous statement, but the general idea is that a home’s appreciation will offset the already low rates of a home mortgage.

Investment Debt

This is a broad category that means different things to different people. An example some of you may be familiar with is student loans. With a student loan, you are borrowing money to invest in yourself and your education. While the payoff (getting a certain job, a higher salary, etc.) is not guaranteed, it significantly increases your chances of attaining your goals. More examples of investment debt include taking out a loan to start a business, a farmer or artist taking out a loan to buy a new piece of equipment, and a real estate investor taking out a loan to acquire a property. A bad example, for obvious reasons, would be starting a floppy disk shop. Unless there is a big floppy disk comeback, this is not a sound investment. My point with these examples is that there will be many opportunities throughout your life to take a risk, and it is your job to distinguish between the investments and scams.

Student Loans

College is an investment. Investments cost money. And it can be surprisingly confusing when trying to figure out how to pay for your borrowed investment. If you received federal loans by filling out the FAFSA, you were also assigned a loan servicer, which is the company in charge of your loan repayment. You can find you federal loan servicer by visiting studentaid.gov.

There are three types of student loans to be aware of:

Subsidized – This is a federal loan that will not accrue interest while you are in school. You will not have to make payments while attending school. There will be a 6-month grace period after graduation until you need to begin making payments.

Unsubsidized – This is a federal loan that will accrue interest while you are in school. You will not have to make payments while attending school. There will be a 6-month grace period after graduation until you need to begin making payments.

Private – This is not a federally distributed loan and will generally have higher interest rates. Repayment terms and grace periods vary between lenders. Many financial institutions offer private student loans.

Given this information, we recommend to take out subsidized, unsubsidized, and private loans in that order until you meet the cost of attendance, and you generally want to repay them in the opposite order.

Repayment

Taking that first step towards repaying your debt can be intimidating. Where to even begin? Don’t worry, we will go over a few proven strategies that can help guide the ship. First, it is important to get your bearings and take an honest look at your total debt. As you are reviewing, keep a list including the loan servicer, debt owed, and interest rate. This list will help decide what loan should be your priority to pay off first. It would also be a good idea to set up auto-pay with your loan servicer(s) as you go. Remember, you still need to make minimum payments to all your loans every month, but using any extra income to pay off loans early will speed you towards removing those financial shackles.

Repayment Picture

Repayment Picture

Avalanche Method – Paying off loans with the highest interest rate first. This method focuses on eliminating the highest interest debt as fast as possible until it is gone, then moving onto the next. This method will save the most money in the long run, but it is difficult to notice the effects of making payments making it harder to stick to this plan.

Snowball Method – Paying off loans with the smallest balance first. This method was pioneered by financial guru, Dave Ramsey. It is easier to stick with this method because there is more psychological reward for paying off a loan altogether. Although, it does not save as much money as its counterpart in the long run.

Early loan repayment is one of the few financial strategies that has a guaranteed rate of return. It is true that a dollar saved is a dollar earned, so working towards paying off debt early will plant the seeds for a strong financial future.

To attract and retain recent graduates, companies are expanding their employee benefit programs to help assist employees with reducing their student loan debt.

Here are trailblazing companies that will help you pay off your student loans faster.